Big news: Aaddress.in is now Address.co ✨

Change Registered Office to a Virtual Office: INC-22 + MGT-14 Checklist (With Samples)

Overview

The main thing that matters when you move your company's registered office to a virtual office is where you're moving it to. This is because it will determine whether you need MGT-14 and INC-22. If the new address is in the same city, town, or village (within the same local limits), you usually need a Board Resolution and an INC-22. If you're moving outside of the local limits but still within the same ROC and State, you'll usually need a Special Resolution, file MGT-14 (usually within 30 days of the resolution), and then send INC-22 with the right SRN reference.

To avoid having to send in your attachments again, make sure they are audit-safe. This includes proof of address (such as an agreement or lease), a utility bill that is no more than two months old, an owner NOC or authorization, and (if asked) photos of the registered office and a list of companies that share the same address. Choose a provider that can handle legal notices and documentation readiness, since the Registrar of Companies (ROC) may check the address. Many virtual office providers, like Address.co, usually share the necessary agreement, NOC, and utility bill set.

Introduction

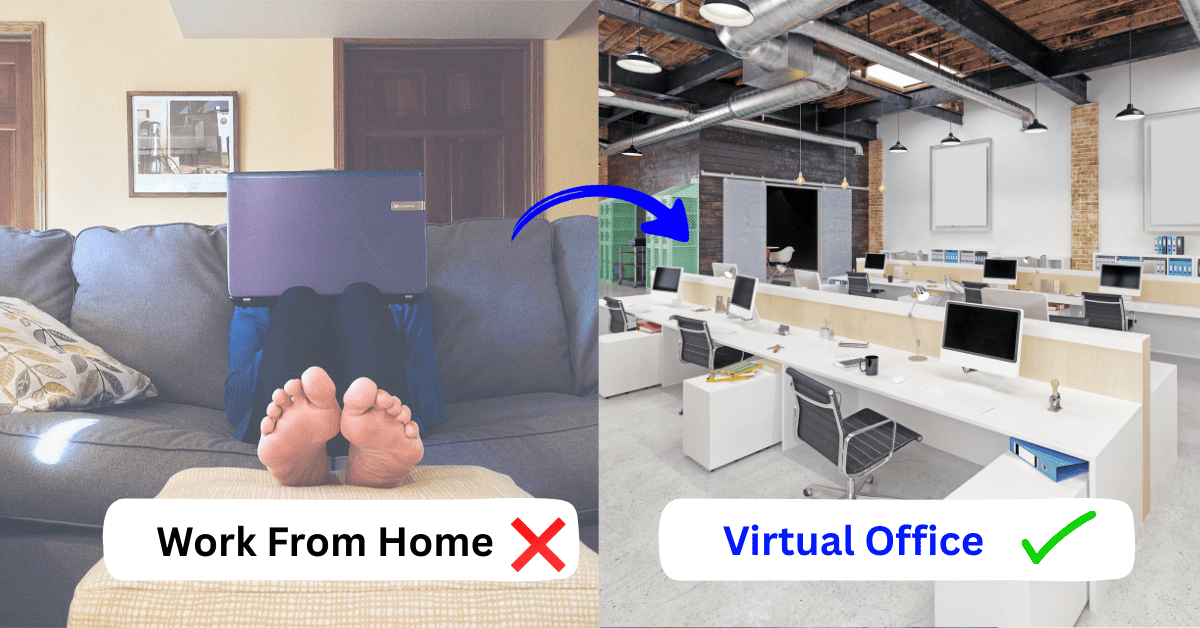

If you work from home but still want to have a professional statutory address, moving your company's registered office to a virtual office for company registration is a good idea. The most important thing is to fill in the right MCA forms and make sure that attachments are safe from audits. The ROC may even check the registered office in person.

Step 0: Check your "shift type" (this is what MGT-14 is based on)

Find out where you're moving before you start the INC-22 registered office change:

- In the same city, town, or village (within the same local limits): Board Resolution + INC-22 (usually no special resolution from shareholders).

- Outside of the local limits but still in the same ROC and state: Special Resolution (for shareholders), MGT-14 filing, and INC-22.

- If you're in a different ROC or state, you might need to get extra approvals or fill out extra forms (not on this list).

Why this is important: MGT-14 is used to file certain agreements and resolutions with the ROC under Section 117, usually within 30 days of the resolution.

The master checklist for INC-22 and MGT-14

A) Papers you usually need to set up a virtual office

You can ask your virtual office provider or owner for:

- Proof of the address of the registered office (lease, rent agreement, or other type of agreement).

- A utility bill for the property that is no more than two months old, as per the instructions and attachments for INC-22.

- Owner permission or NOC that allows the property to be used as a registered office (very important for virtual offices).

- A list of companies (CIN-wise) if more than one company has the same registered office address (INC-22 attachment).

- Pictures of the registered office (some versions of INC-22 ask for pictures of the outside and inside).

Tip: Address.co's virtual office pages and FAQs say that providers usually send an agreement, a NOC, and a utility bill, which is exactly what you need to register for ROC/GST.

B) Approvals from the company (resolutions)

- A board resolution that approves the move and gives a director or CS the power to file forms.

- Only if your shift falls under Section 12(5) scenarios (outside local limits, etc.) do you need a special resolution from shareholders.

Step by step: How to change your registered office address online

Step 1: Always pass the Board Resolution

Hold a meeting of the board and pass the board resolution to change the registered office to approve the new virtual office address and allow filings.

A Sample Board Resolution (within local limits)

"RESOLVED THAT, in accordance with Section 12 of the Companies Act, 2013 and any other relevant rules, the Company's Registered Office will move from [Old Address] to [New Virtual Office Address] starting on [Date].

FURTHER RESOLVED THAT [Name, DIN] be given permission to sign and send e-Form INC-22 and do everything else needed to make this resolution happen.

Step 2: If you need to, pass a Special Resolution and file MGT-14.

If the shift is outside of local limits but still in the same ROC/State, hold an EGM, pass a Special Resolution, and then file MGT-14.

Example of a Special Resolution (not within local limits)

"RESOLVED THAT, in accordance with Section 12(5) of the Companies Act, 2013, the members agree to move the Company's Registered Office from [Old Address] to [New Address] on [Date], and the Board is given permission to file the necessary forms with the ROC."

Step 3: Submit INC-22, the main form for changing your address.

To let ROC know, fill out Form INC-22. The eForm asks for the reason for filing and whether MGT-14 has been filed (Yes/No) and SRN (if applicable). <.p>

Note on the timeline: guidance for INC-22 often says that the ROC should be notified within the legal time frame after the change (often 15 days for a change of registered office).

Checklist for a virtual office (to avoid rejection)

- Make sure that the address can receive and respond to communications and notices (the registered office is a legal communication address).

- Make sure that all of your documents have the same address format, like the agreement, the utility bill, and the INC-22.

- Be "verification-ready": ROC may check the registered office address in person.

Example NOC/Owner Authorisation (for a virtual office)

"I/We, [Owner/Authorized Occupant Name], give No Objection for [Company Name, CIN] to use the property at [Full Address] as its Registered Office starting on [Date]. "Signature, name, address, date."

Disclaimer: This is a practical checklist, so please read it. Requirements change depending on the type of shift and the type of company. Talk to a Company Secretary or CA about your situation.

Subscribe To Our Newsletter

Conquer your day with daily search marketing news.

Most popular Blogs

Current Account with Virtual Office Address: Documents + Bank-wise FAQs (India)

In India, you can open a current account with a virtual office address as...

Read Full ArticleReading Time: 3 min.How to Change GST Address Online (Switch From Home to Virtual Office): Step-by-Step (2026)

Quick Summary: If your GST address is in the same state, you can...

Read Full ArticleReading Time: 4 Mins.How to Choose the Right Virtual Office Service Provider for Your Business in India

Getting an address at a low price is not the only reason to choose a...

Read Full ArticleReading Time: 5 mins.GST Updates Announced in December 2025 | (Latest Compliance Changes, Advisories & State Updates)

Latest GST Updates ICAI has issued an updated Technical Guide on GSTR-9C,...

Read Full ArticleReading Time: 6 Mins.