Big news: Aaddress.in is now Address.co ✨

Current Account with Virtual Office Address: Documents + Bank-wise FAQs (India)

In India, you can open a current account with a virtual office address as long as the address is a valid business or registered address and you can give the bank the proof it needs. The virtual office address bolsters your paperwork for the banks. Also, the GST/MCA/letterhead matches the address you provide.

Here is a useful checklist and some frequently asked questions about virtual bank accounts in India that you can use before you go to the branch or apply online.

Can you use a virtual office address to open a current account?

Yes, a lot of banks will accept a virtual office address when:

- This address is where your Registered Office or Principal Place of Business is located, and

- You can show proof of the entity's address and proof of occupancy (an agreement, a notice of cancellation, or a utility bill), and

- The bank can finish checking (by phone or in person).

Also, banks follow RBI KYC rules. For individuals, RBI FAQs say that accounts can be opened with a deemed address proof and then updated with the current address within a certain amount of time (if applicable).

A list of current account documents that most banks will accept

1) Documents for the entity or business (if needed)

- The PAN of the business, firm, or entity

- Proof of business constitution:

- Company: MOA/AOA and Certificate of Incorporation

- LLP: the LLP agreement and the papers needed to form and register the business

- Partnership: Partnership deed and, if possible, registration

- Proprietorship: Any government-issued registration or licence that has the name and address of the business

Axis, for instance, lists the company's PAN, MOA/AOA, COI, board resolution, and other information for its current accounts.

2) KYC of the person or people who are allowed to sign

- PAN, ID proof, and proof of address

- Pictures as needed (ICICI clearly states the requirements for proof of identity, proof of address, and proof of business).

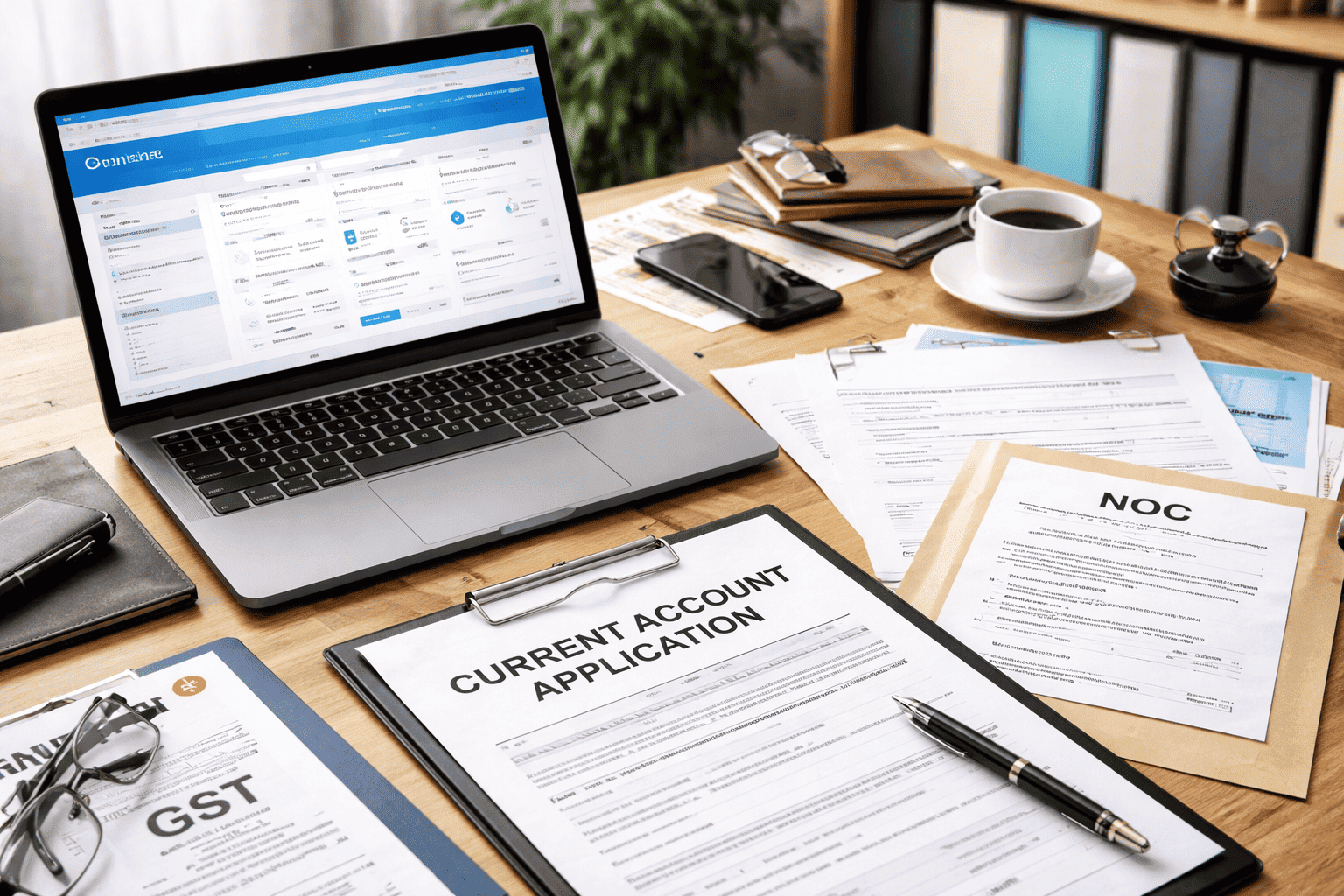

3) Proof of business address for the bank (the "make-or-break" set)

If you work from home, have two or three strong address proofs ready:

- GST registration certificate with the address of the virtual office (if you have one)

- Shop and establishment or other local registration showing the same address (if this applies)

- Agreement for a virtual office or service

- NOC from the address provider (for GST and bank use)

- A recent utility bill for the property (provided by the virtual office provider)

- A board resolution that includes the registered office address (for companies).

HDFC's checklist for opening a current account includes proof of the entity's address, such as GST and Shop & Establishment, among other things.

Quick list of things to do before you apply for a "virtual office"

- The address is the same on the MCA, GST, letterhead, and invoice template

- The agreement, NOC, and utility bill are all up to date and easy to read.

- Signatory KYC address proofs are clean (front and back, valid, and self-attested if needed)

- You can say, "Where do you work from?" (keep website, bills, and proof of clients)

Frequently Asked Questions (FAQs) by Bank

HDFC Bank

Q: What kind of proof of address can I send in for a current account?

A: HDFC's current account checklists usually ask for proof of the entity's address, such as GST and Shop & Establishment certificates. If your virtual office address is on these papers, it usually makes acceptance stronger.

ICICI Bank

Q: What proof of address do I need for a proprietorship current account?

A: ICICI says that proprietorship accounts need two government-issued documents in the business's name that confirm the name and address (registration or licence type documents). That's where GST and registration that show the virtual office address come in handy.

Axis Bank

Q: What papers do businesses need, and where does proof of address fit in?

A: Axis lists things like the company's PAN, MOA/AOA, and COI, proof of the company's address, a board resolution, and KYC and beneficial owner/FATCA declarations for the signatory. Your "company address proof" should show the address of your registered office if it is a virtual office.

Last tip: how to lower the chance of being turned down

When you apply for a current account with a virtual office, don't just rely on an agreement. Along with it, you should have at least one government-issued document that shows the same address (GST/registration). You should also have the NOC and utility bill ready.

Subscribe To Our Newsletter

Conquer your day with daily search marketing news.

Most popular Blogs

Virtual Office in Estonia: Why Indian and Foreign Entrepreneurs Choose It for Company Formation

Estonia’s...

Read Full ArticleReading Time: 7 min.Google Business Profile & Virtual Office Address: What’s Allowed in 2026 (SAB vs Hybrid)

The address you use on your Google Business Profile (GBP) can either help you rank...

Read Full ArticleReading Time: 5 mins.Change Registered Office to a Virtual Office: INC-22 + MGT-14 Checklist (With Samples)

Overview The main thing that matters when you move your company's registered office to...

Read Full ArticleReading Time: 5 minutes.How to Change GST Address Online (Switch From Home to Virtual Office): Step-by-Step (2026)

Quick Summary: If your GST address is in the same state, you can...

Read Full ArticleReading Time: 4 Mins.