Big news: Aaddress.in is now Address.co ✨

How to Change GST Address Online (Switch From Home to Virtual Office): Step-by-Step (2026)

Quick Summary:

If your GST address is in the same state, you can change it online using the GST portal's core-field amendment for the Principal Place of Business (home → virtual office).

Prepare your virtual office documents (proof of address and an agreement or NOC, if necessary), send in your GST amendment application via DSC/EVC, and keep track of it using the ARN.

Once you get the green light, download the new certificate and change the GST address on your invoices, website, and vendor profiles.

Introduction

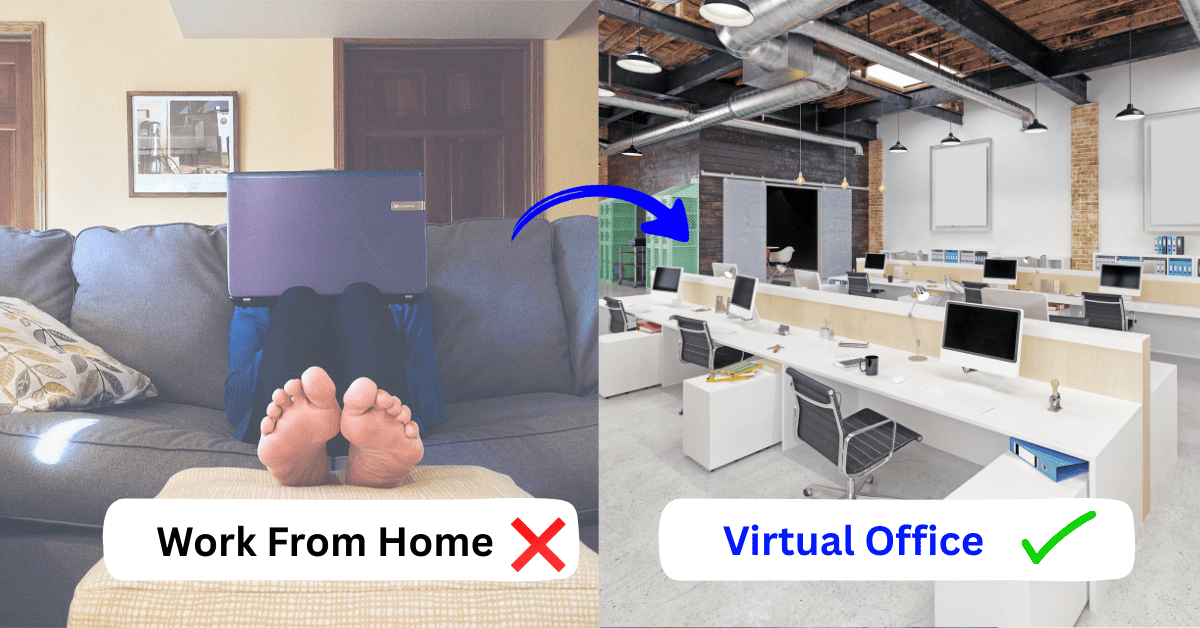

In the beginning, it's common for people to run GST from their home address. But as the business grows, founders often choose a virtual office address for privacy, credibility, and easier vendor and onboarding checks. The good news is that in most cases, you can change your GST address online using the GST amendment application process.

Important note: GST is different in each state. If the "new" address is in a different state, you usually need to get a new GST registration (new GSTIN) instead of changing your address. If it's in the same state, go ahead and change it.

What happens when you go from Home to Virtual Office?

Most of the time, when you switch from a home office to a virtual office, you have to update your Principal Place of Business (PPOB). Changing the address of the PPOB is considered a core-field amendment and is filed through the portal under Amendment of Registration (Core Fields).

Keep in mind that GST changes should usually be filed within 15 days of the change.

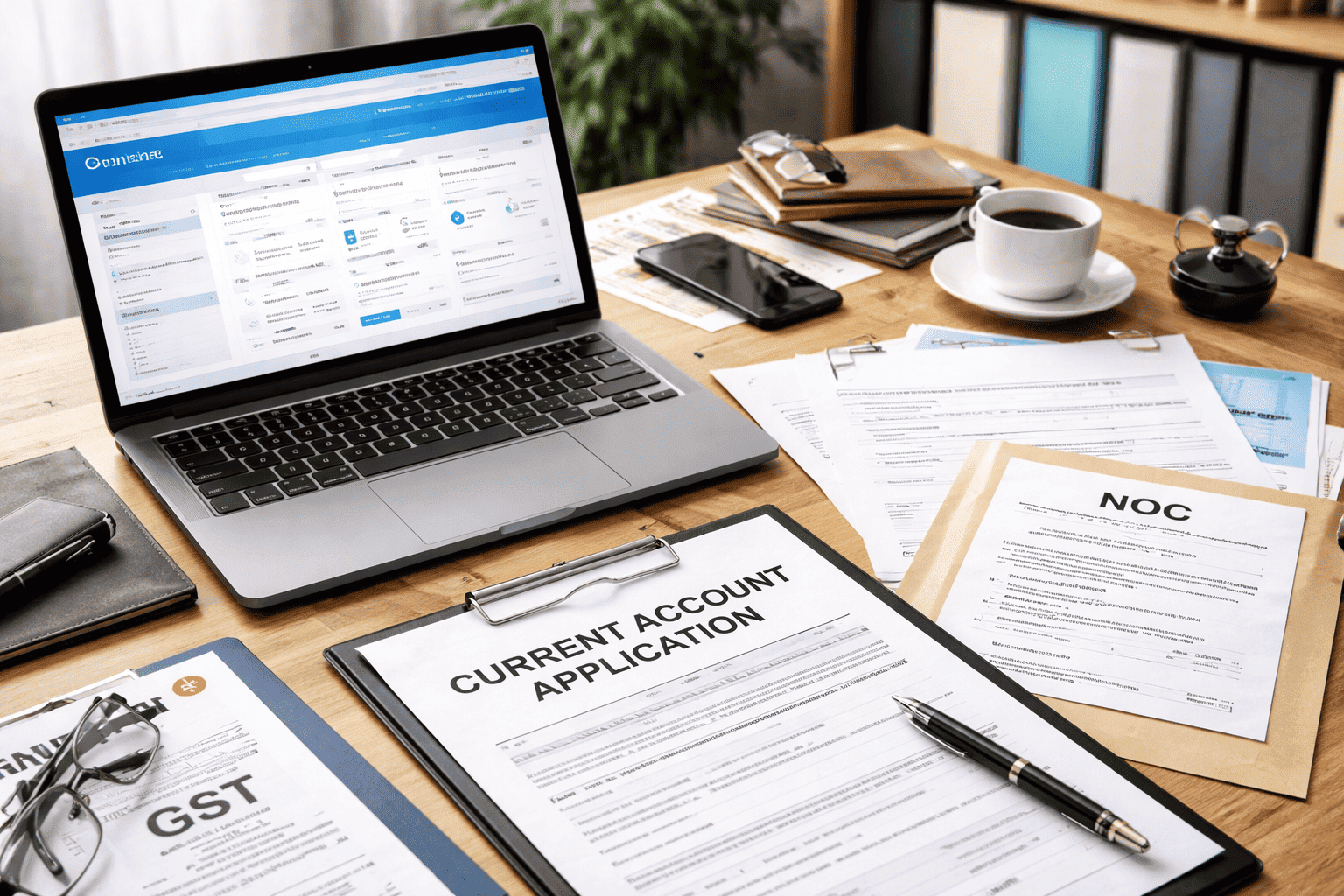

List of documents needed (Virtual Office → GST address change)

For a virtual office GST address change, have these things ready (the exact combinations may depend on the case, rent, or type of ownership):

- Address proof of premises (like a utility bill, property tax, or municipal document-these are all commonly accepted as "proof of place of business")

- Rental or lease agreement (if the property is rented or leased)

- An NOC or consent letter from the owner of the property (this is common for rented or agreed-upon properties)

- Any paperwork your virtual office provider gives you to help you follow GST rules (like an agreement and proof set)

Tip: Make sure that the address you entered matches the proof you uploaded exactly (unit number, floor, building name, and PIN code). The most common reason for queries is small differences.

Step by step: Change the address on your GST registration (PPOB)

Step 1: Sign in and choose the option to make changes

- Visit gst.gov.in and sign in.

- To change your registration, go to Services → Registration → Amendment of Registration (Core Fields).

Step 2: Choose "Main Place of Business"

In the core amendments, click on the Principal Place of Business tab and then click Edit. (PPOB address change goes through a core amendment.)

Step 3: Type in the new address for the Virtual Office.

- Address: building, street, locality, city, district, state, and PIN

- Contact information (if needed)

- Type of possession (rented, leased, consented to, or owned)

- Reason for the change and when it will take effect (make sure this matches what your supporting documents say)

Step 4: Add documents that back up your claim

Upload the utility proof and the agreement/NOC from the checklist, if they apply. The portal flow needs documents to prove that the address has changed.

Step 5: Check and send (DSC/EVC)

To verify, choose the authorised signatory and send the request via DSC or EVC, as needed.

Step 6: Write down the ARN and keep an eye on the status.

After you send in your application, an ARN is made to keep track of it. The officer usually handles core amendments. Keep an eye on portal notices and questions.

Step 7: After getting the green light, download the new Registration Certificate.

Once it is approved, the changed registration or order can be found on the portal

After you get the go-ahead, don't forget these quick updates.

- Change the address on your invoices, letterheads, website, and contact pages.

- Change the addresses in the profiles of vendors and marketplaces (where GSTIN is checked)

- Have a folder ready with the virtual office proofs for any checks or audits

General FAQs

1) Do I need to go to the GST office to change my GST address, or can I do it online?

Yes, you can change your address online by filling out a GST amendment application on the GST portal under Amendment of Registration (Core Fields). Please consult with your GST expert or CA before taking any action.

2) Is it a core change to change the Principal Place of Business (PPOB)?

Yes, changing the principal place of business GST is a core field amendment that is filed through the core amendment flow.

3) What papers do you need to change the address on your GST registration to a virtual office?

You usually need proof of the address of the property (like a utility bill or property document) and, if necessary, a rent or lease agreement and/or owner consent/NOC, just like you do for PPOB changes.

4) Can I just change the GST address if I move from one state to another?

No, usually not. GST registration is different in each state. Usually, if your new address is in a different state, you need a new GST registration (GSTIN) instead of an amendment.

5) Can I change my GST address from my home to a virtual office?

If you have real supporting documents and the address can meet any verification needs (if asked), a virtual office address is often used as the PPOB for GST.

Subscribe To Our Newsletter

Conquer your day with daily search marketing news.

Most popular Blogs

Virtual Office in Estonia: Why Indian and Foreign Entrepreneurs Choose It for Company Formation

Estonia’s...

Read Full ArticleReading Time: 7 min.Google Business Profile & Virtual Office Address: What’s Allowed in 2026 (SAB vs Hybrid)

The address you use on your Google Business Profile (GBP) can either help you rank...

Read Full ArticleReading Time: 5 mins.Change Registered Office to a Virtual Office: INC-22 + MGT-14 Checklist (With Samples)

Overview The main thing that matters when you move your company's registered office to...

Read Full ArticleReading Time: 5 minutes.Current Account with Virtual Office Address: Documents + Bank-wise FAQs (India)

In India, you can open a current account with a virtual office address as...

Read Full ArticleReading Time: 3 min.